Home / Frequently Asked Questions

The UCR Agreement is found in 49 United States Code (USC) section 14504a (hereinafter referred to as section 14504a or § 14504a).

The UCR Agreement is established by federal law in the UCR Act, which is part of the federal highway reauthorization bill known as the Safe, Accountable, Flexible, Efficient Transportation Equity Act, A Legacy for Users (“SAFETEA-LU”), Public Law 109-59, enacted August 10, 2005. The UCR Act is sections 4301 through 4308 of SAFETEA-LU. In particular, the structure of the UCR Agreement is set forth in section 4305 of the UCR Act, which enacts §14504a as a new section in 49 USC.

The UCR Agreement has been amended under Section 301 of the SAFETEA-LU Technical Corrections Act of 2008, Public Law 110-244, enacted June 6, 2008, and in the Rail Safety Improvement Act of 2008, Public Law 110-432, enacted October 16, 2008

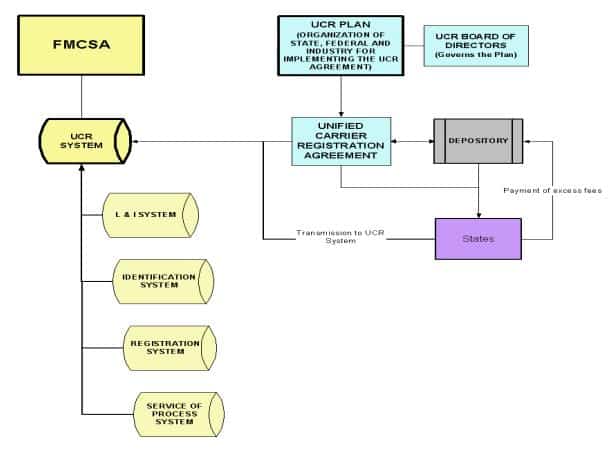

Despite their similar names, UCRS and UCR Agreement have little to do with one another, and the timetables for their implementation are not dependent upon one another. In addition to creation of the UCR Agreement, the UCR Act addresses the consolidation of a number of the currently separate motor carrier databases maintained by the Federal Motor Carrier Safety Administration (“FMCSA”) into a single on-line system to be known as the UCRS. See the following flowchart. The UCRS is a federal computer system of motor carrier data, which under the UCR Act was to be established during 2006 but will in fact require more time to complete. The UCR Agreement is a base-state system administered by federal and state governments and by the motor carrier industry for the collection of fees levied on motor carriers and related entities. It is anticipated by some that future State enforcement of the UCR Agreement may be accomplished by accessing carrier data stored in the UCRS, but the mechanism for doing this is not yet established, and its precise nature remains unclear at this time.

The UCR Plan is the organization of State, Federal and industry representatives responsible for developing, implementing and administering the UCR Agreement. The UCR Agreement is the interstate agreement, developed under the UCR Plan, governing the collection and distribution of registration information and fees generated under the UCR Agreement (“UCR fees”).

No. Section 4304 of the UCR Act imposes certain fees with respect to the UCRS (for example, on motor carriers first applying for federal authority and on some third parties accessing data in the system). Their only purpose is to provide funds to maintain the UCRS. These fees are collected by FMCSA and are federal monies; they have nothing at all to do with the UCR fees.

The UCR Act deals with a number of subjects in addition to the UCR Agreement. Among these is the final repeal of a remnant of federal economic regulation of motor carriers, that is, the distinction between interstate common and contract carriers. Section 4303 eliminated this distinction on January 1, 2007. This provision has nothing at all to do with the UCR Agreement

No. As long as the hazardous materials or hazardous waste annual registration applies to all motor carriers and motor private carriers of property, whether interstate or intrastate, it is not considered an “unreasonable burden upon interstate commerce” under § 14504a(c) because it applies whether or not the carrier is subject to jurisdiction under subchapter I of chapter 135, 49 USC. Likewise, States that are part of the Alliance for Uniform Hazmat Transportation Procedures could continue to require annual renewals and fees.

Note: Section 14504a simply does not deal with hazardous materials carriers or hazardous waste carriers. Interpretations in this document are not intended to mean that hazardous materials carriers or hazardous waste carriers are included in the UCR Agreement.

Section 14504a draws a distinction between the requirements (including the requirement to pay a fee) a State may impose on an interstate carrier when it initially applies for intrastate operating authority, and those requirements that pertain to the renewal of the intrastate authority by an interstate carrier.

UCR Questions and Answers 4 Revised 12/9/2015

A State shall not:

A State may:

No. A State’s other fees and taxes on motor carriers are not affected. In particular, the law contains a provision that specifically states that these federal provisions do not affect the rate of a fuel use tax a State may impose or the rate of its vehicle registration fees.

For purposes of the UCR, a commercial motor vehicle is defined as follows:

A self-propelled vehicle used on the highways in commerce principally to transport passengers or cargo, if the vehicle

The above is consistent with the definition of Commercial Motor Vehicle as set forth in the UCR Act (49 U.S. Code § 31101)

In addition to the prohibitions noted in the answer to question D2, § 14504a(c) prohibits a State from requiring an interstate motor carrier, or motor private carrier of property, to register with it the carrier’s interstate operations, to file information concerning the carrier’s federally required insurance, to file the name of the carrier’s federally required agent for service of process, and to pay any fee or tax from which a carrier engaged exclusively in intrastate operations is exempt.

No. Under Section 14504a, States will not be able to register or collect fees from interstate exempt carriers and interstate motor private carriers of property except under the UCR Agreement. Whether or not a State elects to participate in the UCR Agreement, it may not engage in any of the activities prohibited by the UCR Act.

No, the motor carrier is still subject to the UCR Agreement. Enforcement of operations under a revoked interstate authority is not part of the UCR Agreement.

No. There is no UCR Agreement credential requirement. 49 USC § 14506 includes a general prohibition against State requirements on interstate motor carriers, motor private carriers of property, freight forwarders, or leasing companies to display any credentials in or on a commercial motor vehicle. Although there are a number of exceptions to this general prohibition, none apply to the UCR Agreement.

No. You are not required to carry any proof of compliance in the vehicle. You can carry the receipt for payment of the fees if you choose.

Yes

Section 14504a provides much of the framework for the UCR Agreement, and the rules under which the UCR fees will be collected and administered. To the extent that § 14504a fails to supply what is necessary in this regard, it gives authority to the UCR Board to set such rules and procedures with respect to (at least) what information an entity subject to the UCR fees will need to submit to its Base State every year, the procedures by which an entity can change its Base State, how information will be transmitted from a Base State to the UCRS, transmission of UCR fees from a Base State to the UCR depository, and how the UCR Agreement may be amended.

Yes, it means all interstate transportation of both regulated and exempt commodities as well as both regulated and exempt transportation services. Further, the UCR Agreement is intended to be inclusive of all interstate for-hire motor carriers transporting property or passengers and UCR Questions and Answers 6 Revised 12/9/2015 interstate motor private carriers transporting property and, therefore, it would make no sense to apply the “unreasonable burden” section to certain types of carriers and not to others.

Note: Subchapter 1 of chapter 135 contains §§ 13501 through 13508.

The UCR Agreement is a base-state system, under which a UCR registrant pays UCR fees through its Base State on behalf of all the participating States. A UCR registrant shall select its Base State using the following hierarchy:

Section 14504a(h)(3)(B) specifies that following the distribution of funds from the UCR depository to States that did not on their own collect all the revenue to which they were entitled in a given year, there is to be a distribution to pay the administrative costs of the UCR Agreement. The UCR Board will include in its recommendation of the level of UCR fees an amount to cover the administrative costs of the UCR Agreement.

Yes. Meetings of the UCR Board and its subcommittees are open to the public. Notice of UCR Board meetings will be published in the Federal Register.

Section 14504a(d)(5) requires the UCR Board to establish at least three subcommittees: an audit subcommittee, a dispute resolution subcommittee, and an industry advisory subcommittee. To date, the UCR Board has established an industry advisory subcommittee, an audit subcommittee, a revenue and fees subcommittee, a procedures subcommittee, a UCR systems subcommittee, a best practices subcommittee, and a UCR depository subcommittee. Section 14504a(d)(5) specifies few details of the operations of the UCR Board’s subcommittees, except that the chair of each one is to be a member of the UCR Board and that each one is to include both government and industry representatives among its members. The exception is the industry advisory subcommittee, whose membership is to be entirely made up of industry representatives.

The participating States are Alabama, Alaska, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, and Wisconsin.

The non-participating States are Arizona, Hawaii, Florida, Maryland, Nevada, New Jersey, Oregon, Vermont, Wyoming, and Washington D.C.

Section 14504a(e)(1) specifies that the plan filed by a State must set out which State agency will administer its UCR Agreement program, and that this agency will have the legal authority, resources, and qualified personnel necessary to do so. In addition, the plan must show that the State will use at least as much money for motor carrier safety programs, enforcement, or for UCR Agreement administration as the revenue it will derive from the UCR Agreement.

Yes. Alaska and Delaware did not participate in SSRS but elected to participate in the UCR Agreement, and have an annual entitlement of $500,000. In addition, States may receive an amount up to the amount collected in 2004 from interstate exempt and intrastate renewal fees received from interstate carriers.

Yes. A State may have filed with the USDOT its plan to administer the UCR Agreement prior to obtaining legal authority actually to engage in such administration. It is possible, however, that if without additional legislation a State lacks the authority to collect UCR fees, it might also lack the authority to elect to participate.

That depended on a State’s own constitution and statutes. However, a State generally requires legal authority to collect any fee. Some States may have authority under their existing statutes adequate to collect UCR fees. Others may already have enacted the UCR Agreement enabling laws

Yes. Sections 14504a(e)(1) and (4) specify that if a State was going to participate in the UCR Agreement, it must have filed its plan to do so with USDOT by August 10, 2008, three years following the enactment of the UCR Act. If a State missed that deadline, it may never participate in UCR Agreement.

Yes. Section 14504a(e)(3) specifies that a State may withdraw from UCR Agreement participation by either withdrawing the plan it filed with the USDOT or notifying the USDOT Secretary that it intends to withdraw. If a State does this, it may not thereafter participate in the UCR Agreement.

For for-hire motor carriers transporting property or passengers and motor private carriers transporting property, the UCR fees are based only on the total number of commercial motor vehicles operated. The UCR fees for brokers, freight forwarders (those, that is, that do not operate motor vehicles – the UCR fees of those that do are based on fleet size), and leasing companies are levied at the smallest fee category. UCR fees depend not at all on the extent of a carrier’s operations, only on the fact that it is engaged to some extent in interstate commerce. A carrier may, for example, have operations in just a few States, none of which participate in the UCR Agreement. Its UCR fees will be the same as a carrier that operates the same number of commercial motor vehicles but whose operations extend to all participating States. Neither will it matter under the UCR Agreement, which State is acting as a carrier’s Base State – the level of UCR fees for a fleet of a given size will stay the same.

No. UCR fees will be set through a graduated structure of rates according to the number of commercial motor vehicles operated by a motor carrier, or motor private carrier of property, during the preceding year. Changes during the UCR Agreement registration year in the number of vehicles operated will not be reflected until the following year and the carrier will not need to report them currently.

Section 14504a(d)(7) requires the UCR Board to recommend every year to the USDOT

Secretary the level of UCR fees to be effective the following year, and requires the USDOT

Secretary to actually set the UCR fees within 90 days following the UCR Board’s recommendation. This process requires formal notice and opportunity for public comment. Implicitly, in order for the UCR Board to make such a recommendation, the UCR Board must determine which States are going to participate in the UCR Agreement in the following year, what the aggregate of these States’ UCR Agreement entitlement revenues may be (plus what amount of UCR Agreement administrative costs are to be recouped through the UCR fees), how many entities are subject to the UCR Agreement and how many commercial motor vehicles they operate, and what structure of UCR fees will best serve to collect the revenue calculated to be needed.

Disclaimer: The answers provided here are based on the informal interpretation of the Unified Carrier Registration Act of 2005 (“UCR Act”) by the Unified Carrier Registration Plan Board of Directors (“UCR Board”) and are subject to further interpretation by the UCR Board. The answers given here do not limit or restrict future UCR Board interpretations or the UCR Board’s implementation of the UCR Act or the Unified Carrier Registration Agreement (“UCR Agreement”).

The UCR Plan is the organization of State, Federal and industry representatives responsible for developing, implementing and administering the UCR Agreement. The UCR Agreement is the interstate agreement, developed under the UCR Plan, governing the collection and distribution of registration information and fees generated under the UCR Agreement.

Copyright © Unified Carrier Registration (UCR)